In Indian lending market NBFCs(Non-banking Financial Corporations) played a crucial role in building a nation by providing easy and quick credit. As of 2022, 9500 NBFCs were registered with the RBI, holding assets worth ₹42.05 lakh crore, and assets under management (AUM) for NBFCs rose from ₹27 lakh crore. They surpass the traditional banks, provide credit for solopreneurs, and empower rural and underserved communities with innovative financial services.

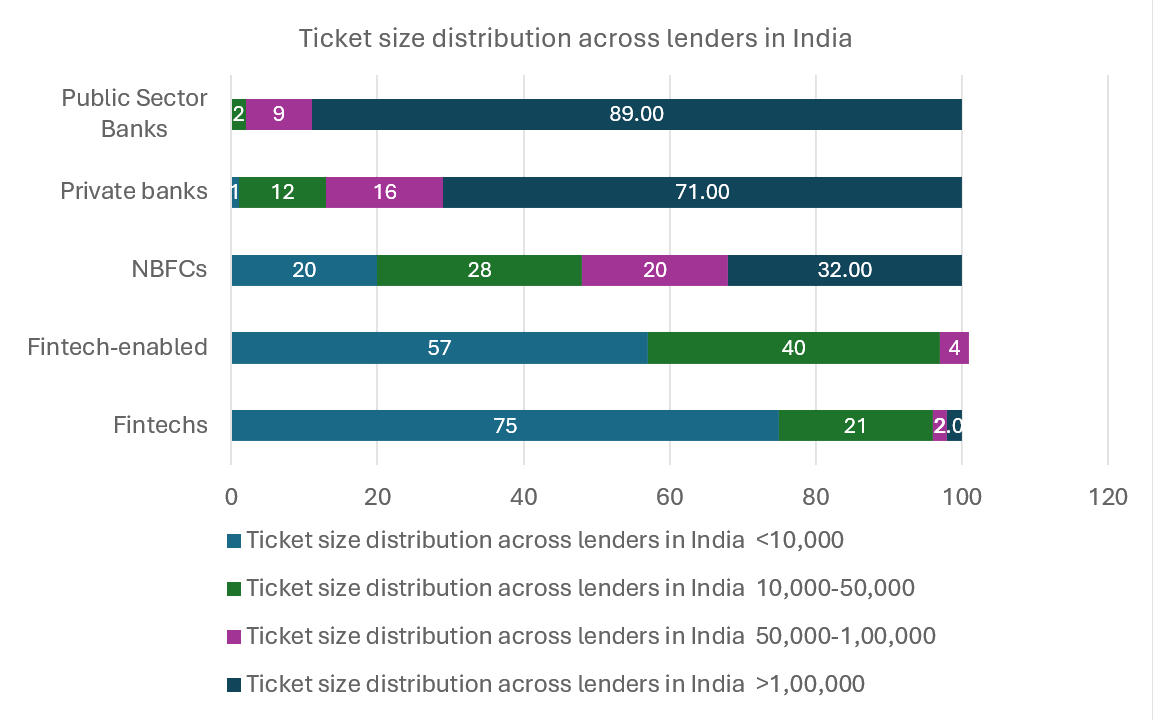

From the above graphs, NBFCs offer a balanced distribution across all loan sizes but focus significantly on larger loans, with one-third of their loans exceeding INR 100,000. This diverse approach allows them to meet various economic and financial needs effectively of individual and micro &small enterprises. As of March 2023, they account for almost one-fifth (18.7%) of total banking assets, up from just 13% ten years ago. Tech-savvy NBFCs focused on lending through apps and online platforms, as well as housing finance companies, are reaching out to customers in the remotest parts of the country using digital technology. The housing loan segment alone saw a massive 22.8% annual growth as of September 2022.

Let’s take the story of FinLEO (Fictious), a small NBFC that started by providing tiny loans, called ‘microloans,’ up to 5 lakhs to people who usually faced long delays in getting loans from regular banks. For those struggling with piles of paperwork and bureaucratic red tape at big banks, the nimble services of FinLo came as a breath of fresh air. This is why many underserved individuals and small businesses prefer to approach FinLo for their credit needs.

In the beginning, FinLEO was doing well—swiftly disbursing these small loans, helping borrowers grow their ventures, and bringing basic banking services closer to the masses. This made FinLo a shining example of how NBFCs can financially empower those left out by the conventional banking system.

However, when the personal loan market started booming and offering higher profits, FinLEO got tempted and decided to shift its focus there. Personal loans were growing at an unbelievable 33% yearly rate over the past four years, which seemed like a golden opportunity. But this explosive growth led to reckless lending practices by FinLEO. They started approving loans without properly checking applicants’ ability to repay typically focused on their credit history. This resulted in increasing bad loans or NPAs (non-performing assets) on their books. The strategy that promised quick growth soon became FinLEO’s biggest problem, landing them in financial trouble. FinLEO realized it needed to get a better handle on its rising bad loans issue. So they decided to implement a smart new system called an “acquisition scorecard” that uses machine learning and advanced data analytics.The way this scorecard works is quite neat. It studies each loan applicant’s financial details and other data to calculate how risky or safe they are to lend to. Based on this, it puts applicants into three buckets – high risk, medium risk, and low risk of defaulting on their loan.

This risk segmentation is extremely valuable for FinLEO. It allows them to focus their efforts on applicants who are most likely to repay their loans properly. At the same time, they can be cautious with riskier applicants to avoid future bad loans (NPAs).

The Acquisition scorecard

But what exactly goes into calculating this risk score? The acquisition scorecard looks at a whole range of data points beyond just income and existing loans. It considers spending patterns, rent payments, utility bill histories and more to understand the person’s financial discipline. It’s like creating a comprehensive report card that grades an applicant’s money management skills. Having a low income alone doesn’t make you a bad loan risk if you pay all your bills diligently.

The process starts by collecting data from credit bureaus, FinLo’s own records, bank statements and other sources. This raw data is then cleaned up and formatted properly. Finally, it is fed into advanced statistical models to calculate risk scores.

For example, those with a high 700+ CIBIL score get a different rating compared to those under 700. However, the models also look at other factors like geographical trends in repayment behavior. This multi-dimensional approach helps FinLo make smarter lending decisions. They can predict potential defaults more reliably and customize loan offers as per each person’s risk level. Lower risks may get higher loan amounts and better rates, while higher risks could have smaller loan caps.

Just like FinLEO, other NBFCs, housing finance firms, and small business lenders are also seeing the big benefits of using advanced technologies like artificial intelligence (AI) and machine learning. By using smart ‘acquisition scorecards’, they can remove old-fashioned hurdles in the loan approval process and make faster, fairer lending decisions.

Some of the possible benefits of using acquisition scorecards in lending:

- More Accurate Risk Assessment: Scorecards analyze diverse data points beyond income and credit scores, improving the accuracy of evaluating financial behavior and reducing the risk of defaults.

- Faster Decision-Making: Automated scorecards and advanced models streamline the loan approval process, enabling quicker decisions and reducing operational costs for lenders.

- Tailored Loan Offers: Lenders can customize loan terms based on individual risk profiles identified by scorecards, offering better terms to low-risk borrowers and adjusting terms for higher-risk applicants accordingly. This approach optimizes loan management and enhances customer satisfaction.

This can have a huge positive impact, especially for small and medium enterprises (SMEs). The latest MSME Pulse Report shows that a whopping 59% of the sector faces delays in getting timely credit from formal sources like banks. This credit gap has only widened during economic uncertainties which is not for the long run. AI-powered scorecards can help bridge this gap by efficiently identifying small businesses that deserve a loan but may have been overlooked by traditional loan approval methods that only look at financial data. By considering factors like digital presence, utility payment histories, and other non-financial data points, the AI models can reveal the true risk profile of these SMEs.

Discover the transformative potential unlocked by Valiance Solutions in driving digital innovation. Our cutting-edge credit platform integrates advanced machine learning algorithms and utilizes alternative data sources to swiftly evaluate customer eligibility and dynamically adjust credit limits based on intricate transactional patterns, achieving a remarkable 60-70% enhancement in accuracy check it out here. This innovative approach not only streamlines loan processing times to mere minutes but also exemplifies Valiance Solutions’ dedication to reshaping the landscape of financial services. Valiance Solutions prioritizes delivering exceptional customer experiences through personalized financial solutions. Collaborating with leading financial institutions, we have achieved significant results, including a notable 10% increase in conversion rates and portfolios with 10-20% higher ticket sizes. Explore our comprehensive case studies on AI-driven credit risk assessment for micro customer loans here and our successful partnership in enhancing personal loan penetration for more information visit here

Rajneesh Singh is a seasoned professional with experience in ship operations. He has a comprehensive marketing, sales, and process optimization background within the maritime industry. Rajneesh is dedicated to enhancing operational efficiencies and implementing effective strategies to drive success. Alongside his maritime expertise, he has a keen interest in fintech, staying abreast of the latest developments and innovations in financial technology. His diverse skill set and passion for continuous learning make him a valuable asset.