Understanding the Lending Landscape

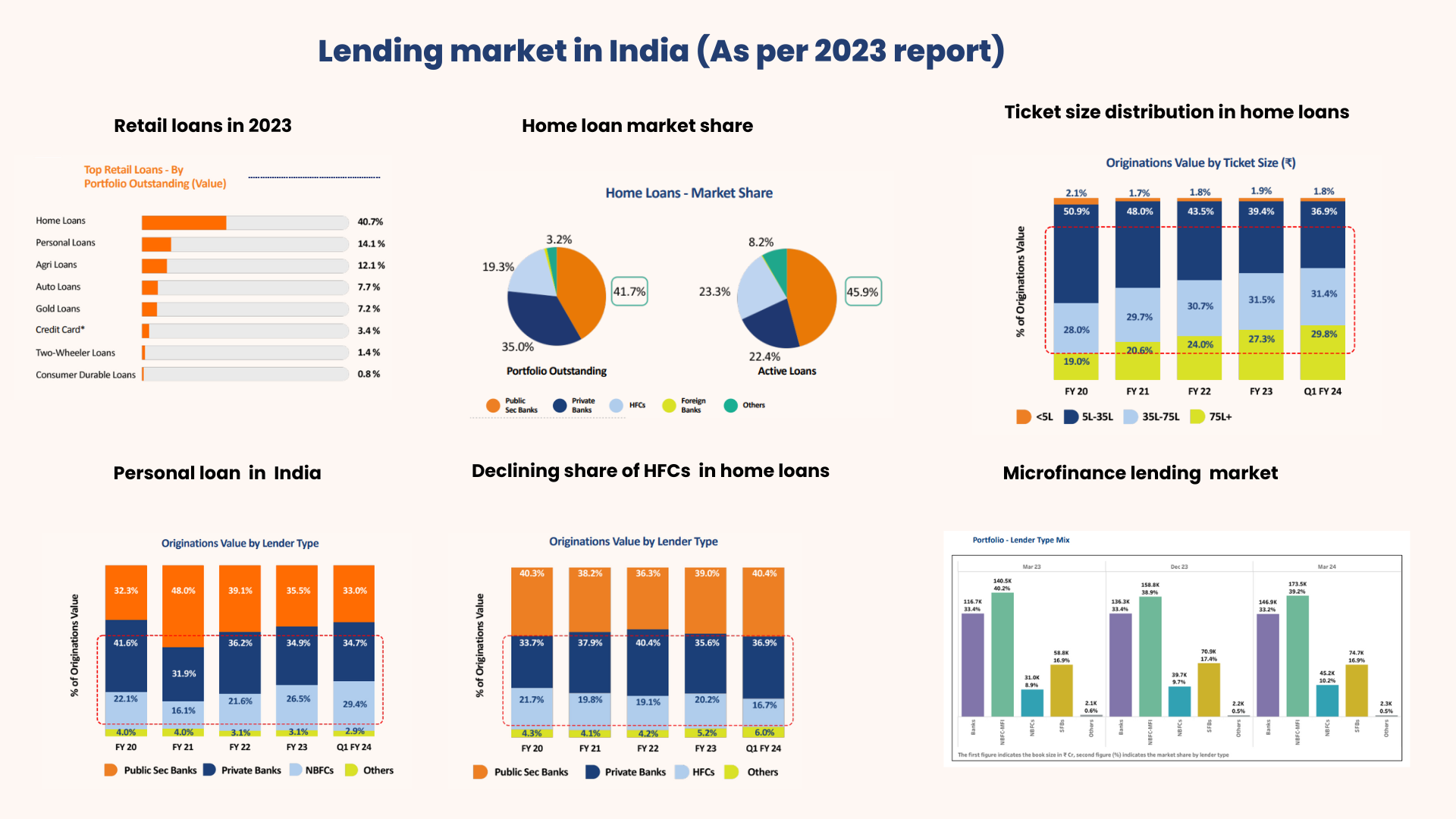

Imagine you’re the captain of a ship navigating through the vast and sometimes stormy seas of the Indian lending market. Your crew consists of various lenders – public sector banks, private banks, housing finance companies (HFCs), and microfinance institutions in housing loans. Each has its way of steering through the waters. For ease of understanding below image is self-explanatory-

Shifting Landscape of Loan Originations

- Home Loans Dominate: Home loans account for 40.7% of retail loans in 2023.

- Market Share: Public sector banks hold 41.7% of home loans, while private banks have 45.9% of active loans.

- Larger Home Loans: Loans above ₹75 lakh are growing, showing a trend toward higher ticket sizes.

- Declining HFCs: Housing Finance Companies (HFCs) are losing share to public and private banks.

- Personal and Microfinance Loans: Private banks lead in personal loans; NBFCs-MFIs and SFBs dominate microfinance.

Analysis:

- Rise in High-Value Loans: Higher demand for large home loans due to rising property prices.

- Competitive Home Loan Market: Public and private banks are competing fiercely.

- HFCs Losing Ground: Traditional banks are taking over the home loan market.

- Diverse Personal Loan Market: Private banks excel in offering tailored financial products.

- Microfinance Growth: Essential for financial inclusion and supporting underserved communities.

The Indian lending market is evolving, driven by a shift towards higher value loans and increased competition among banks and it also comes with challenges like NPA’s or Non-Performing Assets

Enter Early Warning Systems

In the dynamic world of banking and financial services, managing credit risk is crucial for maintaining portfolio health and ensuring sustainable growth. With the increasing complexity of financial markets and the growing volume of credit transactions, traditional risk management approaches are no longer sufficient. This is where early warning systems (EWS) come into play, offering a proactive solution to identify potential credit risks before they escalate into significant issues.

An effective early warning system leverages advanced analytics, machine learning, and real-time data monitoring to detect early signs of credit deterioration. By providing timely alerts, these systems enable financial institutions to take preventive actions, optimize their risk management strategies, and safeguard their portfolios from potential defaults and losses.In this blog, we will delve into the importance of early warning systems in credit risk management. We will explore how these systems can enhance decision-making processes, improve portfolio performance, and ultimately contribute to a more resilient financial ecosystem. Join us as we uncover the key benefits and best practices for implementing an early warning system, and learn how it can transform your approach to credit risk management.

Key Data Sources-

Banks gather information from various places to keep an eye on their loans and borrowers. Here are some of the main sources:

- Loan Management Systems (LMS)/Re-Payment Track Report (RTR): These systems hold all the details about current loans and repayments, helping banks track how each loan is doing.

- Credit Bureau Scrubs: These are detailed credit reports showing a borrower’s credit history, including their credit score and outstanding debts.

- Macroeconomic Variables: These are big-picture economic factors like interest rates and unemployment rates, which can impact a borrower’s ability to repay loans.

- Customer touchpoint- It is a touchpoint is any interaction or communication between a customer and a official bank employee throughout the customer journey

- Important Variables-From these data sources, banks create some key indicators to help assess risk. Some of them are-

- Oncycle– Tracks if borrowers are making their payments on time.

- Normax– Measures the maximum debt levels of a borrower compared to what is considered normal for similar profiles.

- Score– A numerical value representing the risk of a borrower defaulting on a loan.

- Default Probability– The likelihood that a borrower will default on their loan obligations within a specific time frame.

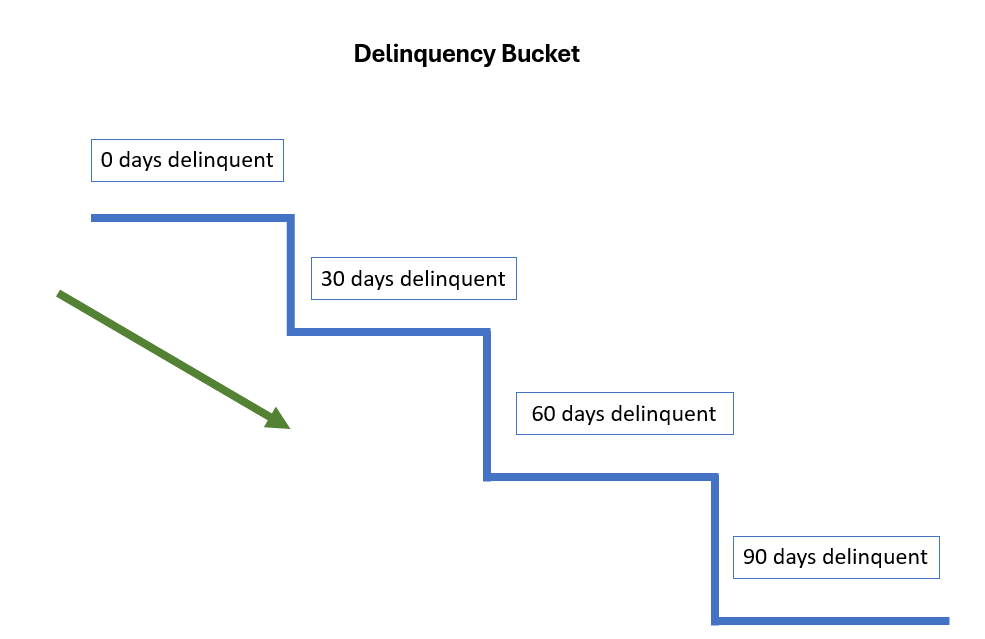

- Delinquency Rate-The percentage of loans in a portfolio that are past due.

- Repayment History- Historical record of the borrower’s loan repayments.

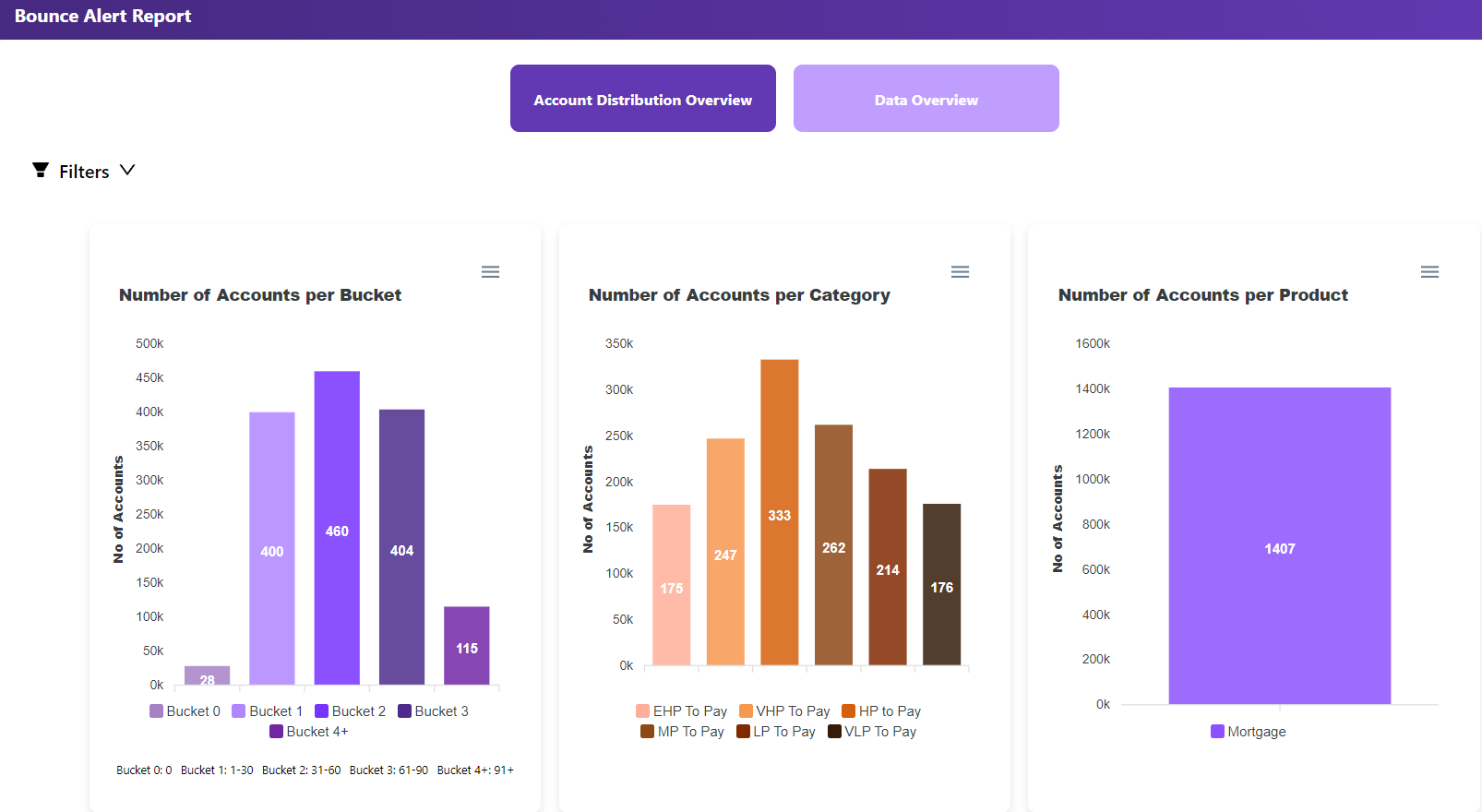

This score helps in categorizing borrowers into different risk buckets and determining the level of monitoring required, Risk Scores and Buckets. Each borrower gets a risk score based on these variables. This score helps banks categorize borrowers into different risk levels, or “buckets”:

- Low Risk: These borrowers are likely to repay on time, so they need only standard monitoring.

- Medium Risk: These borrowers show some signs of potential trouble, requiring closer monitoring and possible intervention.

- High Risk: These borrowers are likely to default on their loans, requiring immediate action to mitigate potential losses.

How it looks like-

Cash Flow Forecast

Cash flow forecasting is another important part of EWS. It predicts how much money will come in and go out of a borrower’s accounts in the future. This helps banks see if a borrower will have enough cash to make their future loan payments, providing a clearer picture of their financial health.

The Role of EWS

EWS acts as an advanced radar system, detecting potential fraud early. It identifies “Red Flagged Accounts” (RFAs) where warning signals suggest issues. Banks must monitor these signals, investigate suspicious accounts, and report findings to the RBI. This proactive approach allows banks to act quickly, reducing major loss risks and maintaining trust in the financial system.

Benefits of EWS

- Minimize Default Rate: Identifies high-risk borrowers early to prevent defaults.

- Assist in Loan Approval: Provides insights for informed lending decisions.

- Enable Stringent Agreements: Structures loan agreements with safeguards for higher-risk borrowers.

- Determine Portfolio Composition: Optimizes loan portfolio decisions on sizes and borrower profiles.

- Facilitate Securitization: Improves risk assessment for efficient securitization of loan assets.

As the sector continues to evolve, the integration of sophisticated EWS will likely become a key differentiator between banks that thrive and those that struggle with asset quality. For a robust and resilient banking sector, embracing these technological solutions is not just an option – it’s a necessity. At Valiance Solutions, we are leading the charge with our cutting-edge AI and data analytics solutions. We’ve partnered with credit rating companies to create a credit risk scoring model for micro and small consumer loans using AI. We’ve also developed automated systems to monitor the effectiveness of customer engagement initiatives, ensuring a healthy growth portfolio for lending companies. Using advanced machine learning algorithms, data engineering, and cloud technology, we are transforming the way banks manage risks and seize opportunities.

Let’s keep our ships sailing smoothly by harnessing the power of Early Warning Systems. Together, we can navigate the complexities of the lending market and ensure a prosperous future.

Rajneesh Singh is a seasoned professional with experience in ship operations. He has a comprehensive marketing, sales, and process optimization background within the maritime industry. Rajneesh is dedicated to enhancing operational efficiencies and implementing effective strategies to drive success. Alongside his maritime expertise, he has a keen interest in fintech, staying abreast of the latest developments and innovations in financial technology. His diverse skill set and passion for continuous learning make him a valuable asset.