On 15th February 2025, a deadly stampede at New Delhi Railway Station claimed the lives of eighteen people—several of them children. What began as a routine platform change quickly spiraled into chaos due to miscommunication, crowd mismanagement, and a lack of real-time oversight. Within minutes, panic spread. Passengers rushed in different directions, and the resulting crash became fatal. This tragedy exposed a harsh reality: in one of the world’s most densely populated countries, crowd safety remains one of the most neglected aspects of public governance.

Unfortunately, this was not an isolated case. India has witnessed similar crowd-related tragedies time and again—during religious festivals, political rallies, public protests, and transit delays. These events, meant to bring people together, have too often ended in sorrow. Beyond the devastating loss of life, the consequences extend to damaged infrastructure, stalled transportation, financial loss, and a growing public distrust in the ability of authorities to manage crowds effectively.

Even places of worship meant to be spaces of peace and reflection have become high risk during major events. In the absence of modern systems to monitor crowd density or flow, a peaceful gathering can turn into an emergency zone within moments.

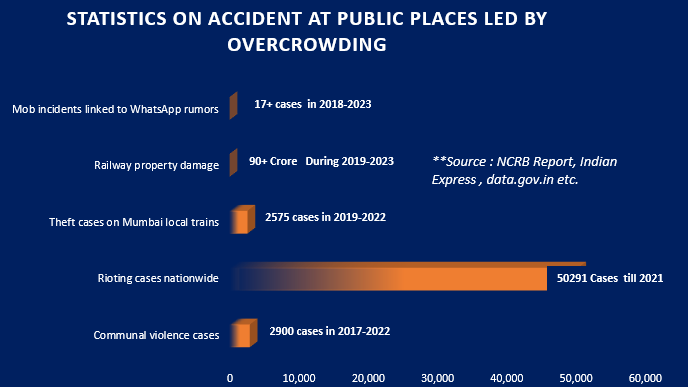

The underlying issue is clear, overcrowding but it doesn’t happen all at once, it builds gradually and some of the accidents are generally directly linked to overcrowding.

- Tensions escalate quickly- a small misunderstanding in a crowded space can spark a physical altercation.

- Criminal activity becomes easier– Pickpocketing and petty theft thrive in dense crowds where offenders can easily disappear.

- Harassment often goes unnoticed -Molestation and inappropriate behaviour, especially against women, are harder to detect and prevent in tightly packed spaces. A study by UN Women shows that 91% of women in Delhi faced harassment in public places, and 78% faced it in crowded transport.

- Vandalism can break out suddenly – When public systems fail or crowds become frustrated, property damage and violence may follow. In India, public property damage is more like a fashion of showing anger at public places.

- Emergency access is blocked- In medical situations, responders often can’t reach victims in time due to restricted pathways.

The Below image is sufficient to draw risk, accident, and impacts

The Tech Opportunity: AI, GenAI, & Vision Analytics

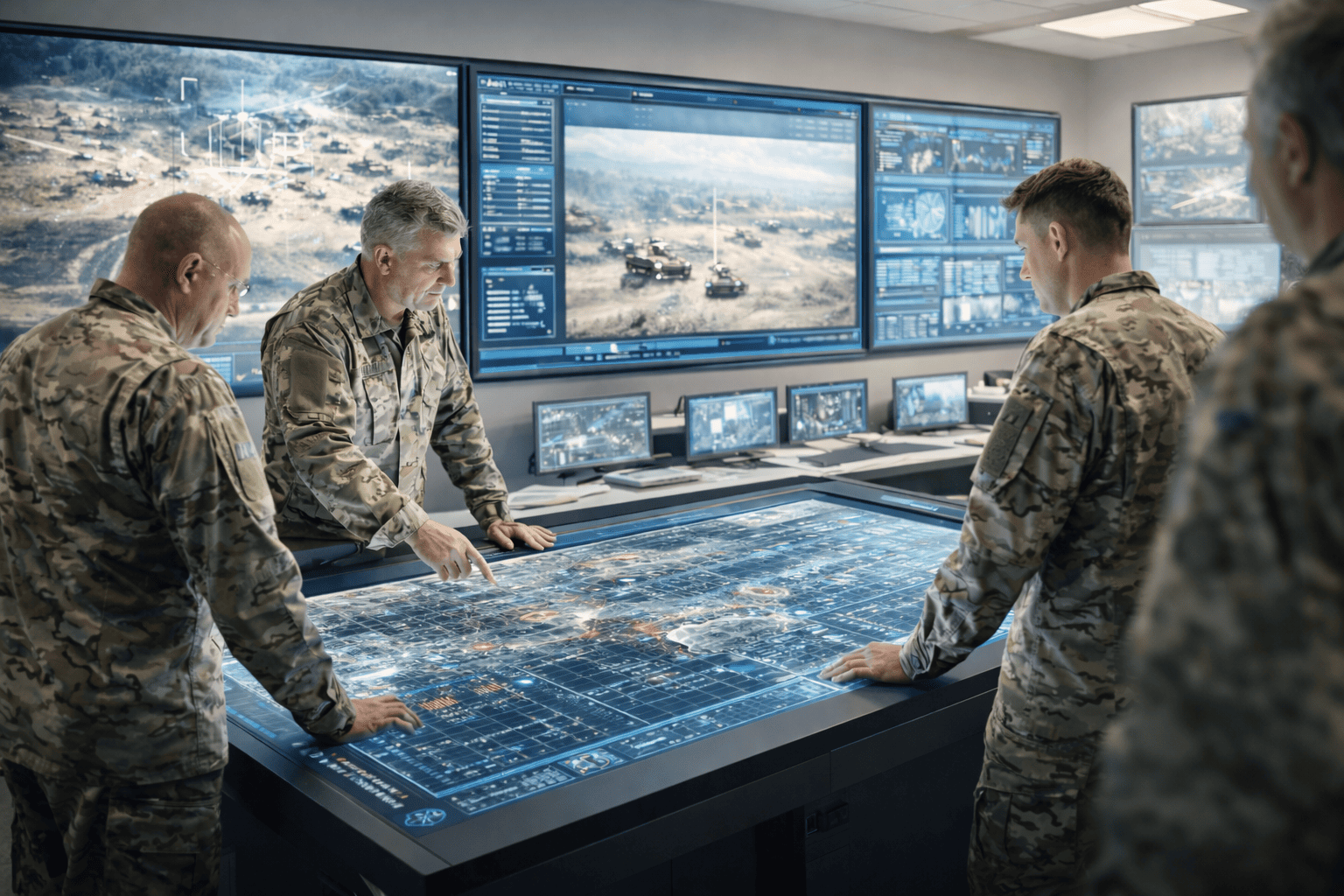

To bridge this gap, India must look toward intelligent crowd management systems powered by Artificial Intelligence, Generative AI, and Vision Analytics. These tools can bring visibility, speed, and precision to public safety in ways that traditional methods cannot. It looks like

- AI-powered predictive analytics identify congestion trends before they become threats.

- Vision analytics detect anomalies in real time, such as crowd surges, sudden movement patterns, or restricted access violations.

- GenAI tools help issue dynamic alerts, and multilingual notifications, and simulate emergency scenarios for training responders.

- Smart dashboards visualize heat maps, crowd density, and emergency pathways—helping decision-makers act faster and smarter.

How it works

Step-by-Step Crowd Monitoring with AI

- Cameras capture live crowds at a certain level– Smart cameras are placed in busy areas to watch and record how people are moving in real time.

- AI checks for crowd build-up or movement issues – The system uses computer vision to spot if a crowd is getting too big or if people are moving in unsafe ways.

- Fast processing using edge or cloud systems – The video is processed quickly using special computers (called edge or cloud systems), so there’s no delay.

- AI looks for unusual or risky behaviour. It keeps an eye out for warning signs—like people rushing, pushing, or suddenly changing direction.

- Alerts are sent instantly to security teams – When something looks risky, the system sends a message to safety teams through their phones or control systems.

- Live heatmaps show where the danger is – The system creates a color-coded map showing where the crowd is getting too heavy or unsafe.

- The public gets clear instructions – Loudspeakers, screens, or mobile messages tell people where to go or how to stay safe—right when it’s needed.

We can also understand it by the below figure in simple terms

Some of the public concerns and their possible responses are outlined in the table below:

Some of the measurable Results of the above-described solution are listed below-

- Reduced risk of stampedes and crowd-related accidents– Real-time video analytics detect sudden crowd surges, helping prevent disasters in busy public places.

- Faster emergency response in high-traffic zones-AI-powered alerts enable rapid dispatch of medical and security teams to critical areas, reducing response delays.

- Optimized crowd movement at transport hubs and events visual tracking systems help reroute foot traffic away from congested zones, easing pressure on entry and exit points.

- Data-driven planning for high-density venues-Continuous crowd flow data supports smarter layout design and safety planning at festivals, train stations, and stadiums.

Similar to some of the broader Impacts on Public Safety

- Increased public confidence in crowd safety technology

- Lower stress and panic levels during large gatherings

- Higher trust in public infrastructure and city governance.

- Safer environments for women, children, and vulnerable individuals

- Progress toward smarter, safer urban mobility systems

Just think If intelligent crowd monitoring powered by Vision AI and Generative AI (GenAI) had been deployed on 15th February 2025, the tragic stampede at New Delhi Railway Station might have been prevented. The system could have detected real-time crowd surges triggered by the sudden platform change and immediately alerted security teams to take action. Automated public announcements, digital signage, and alerts could have delivered clear instructions across the station, helping to manage panic and guide passenger flow. With AI-driven crowd flow control, chokepoints at stairs and exits could have been minimized. Emergency responders would have had access to live heatmaps and location-based data, allowing for faster and more precise interventions. Additionally, the system could have optimized resource deployment, ensuring the right number of personnel were positioned in critical areas. Most importantly, this real-time crowd management solution might have prevented the escalation entirely—and saved eighteen lives. Implementing AI for crowd safety isn’t just a future possibility—it’s a necessary step toward building safer, smarter public spaces.

Civic Eye by Valiance Solutions is a solution that has one feature similar to the crowd-monitoring system that helps detect problems before they turn into emergencies. With the power of real-time Vision AI, it monitors crowd movement and sends early alerts when overcrowding begins—helping prevent stampedes, delays, or panic. Security teams can respond quickly while automated alert messages guide people safely during disruptions. From railway stations and public events to industrial zones and private venues, Civic Eye helps manage large groups with ease. It’s a reliable solution for anyone looking to improve public safety, crowd control, and emergency preparedness.