We all strive for a healthier life. We track our steps, eat right, and feel invincible as part of the global $66.3 billion fitness revolution in 2023. But here’s the harsh reality that might make you rethink , 19.8 million hearts stopped beating last year alone, and the families of those who passed faced not just grief, but financial devastation. Even more alarming? Half of all heart attacks occur in people with perfectly normal cholesterol levels—individuals who thought their health insurance had them covered. The cruel irony? While we’ve been perfecting our workout routines, the health insurance industry has been failing to protect us when we need it most. This is where your health insurance should be your financial lifeline, not a financial nightmare. Yet millions discover too late that their carefully selected health insurance policies crumble under the pressure of real medical emergencies.

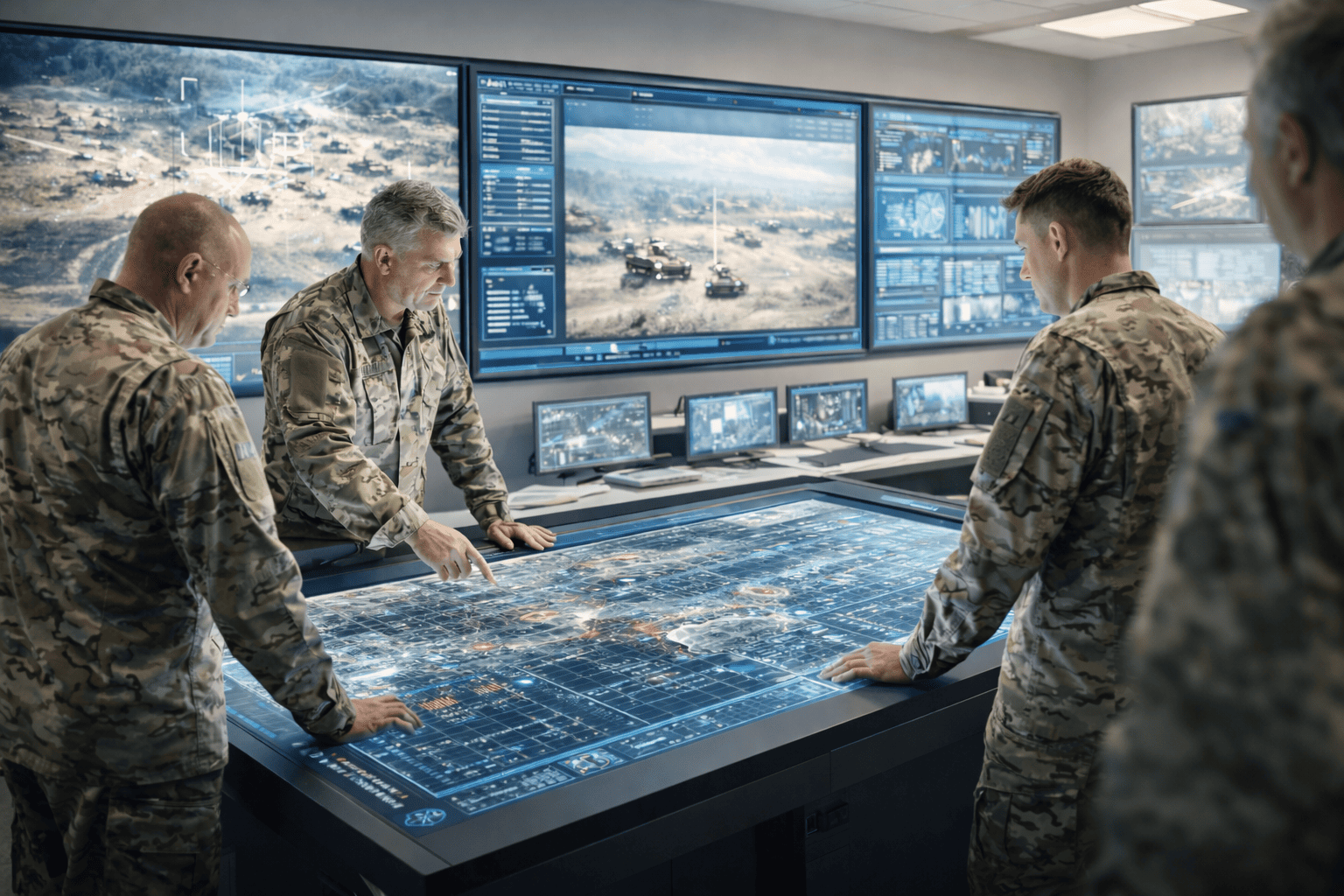

The health insurance crisis deepens when we consider the financial burden on families. Medical costs are rising by 14% annually worldwide, creating a double burden for families who believed their health insurance would protect them. Between skyrocketing healthcare expenses and inadequate health insurance coverage, families are left facing not only medical trauma but also financial devastation.Here’s where the health insurance industry should serve as a safety net. But too often, it’s their greatest source of stress. 60% of health insurers now offer wellness programs and preventive care benefits. Leading insurers are designing plans that reward preventive care, including annual check-ups, vaccination coverage, and wellness program access.The below image illustrates about the health insurance industry in India-

The Indian Health Insurance Reality Check

In India, the reality is starkly different. A recent survey revealed that 63% of respondents feel their health insurance does not adequately cover their health risks. While 40% appreciate timely health insurance claim settlements, the coverage gap leaves many dissatisfied.

The numbers paint a troubling picture of health insurance in India:

- 38% understand their policy terms but still find them confusing.

- 37% believe health insurance premiums are too high for the coverage they receive.

- 65% of health insurance claim delays stem from inconsistencies in healthcare practices.

This has led to widespread skepticism, with many questioning whether their health insurance provides genuine value for money. As a result, consumers are constantly switching between health insurance providers, desperately seeking better service and coverage.

The bottleneck in the process

The biggest bottleneck in health insurance claims processing isn’t fraud or regulations—it’s the chaos of micro-practices across hospitals, clinics, and diagnostic centers. From handwritten prescriptions to inconsistent billing codes, these small but widespread inconsistencies cause 65% of health insurance claim delays.

Here’s a breakdown of the typical 8-step health insurance claim process

Some of the key challenge which comes in the process are:

- Documentation Disasters: Many healthcare institutions lack uniformity in submitting medical records to insurance companies, creating delays due to missing or inconsistent information.

- Billing Code Chaos: Non-standardised billing codes lead to discrepancies and claim rejections when insurers expect uniform coding.

- Manual Processing Nightmares: Relying on manual processes for claim submissions creates inefficiencies and increases error rates.

- Communication Breakdowns: Each healthcare provider has unique documentation protocols, which don’t align with insurance company standards, causing confusion.

- Follow-Up Failures: Smaller healthcare institutions lack dedicated staff to handle claim-related queries, leading to slower response times and prolonged processing.

- Micro Practices among healthcare: Micro practices are rampant in our country, leading to confusion about what is truly needed for settlement. This creates a gap between the required information and what is actually provided for claim processing

These issues result in customer frustration, particularly when it comes to claim reimbursements and excessive paperwork, forcing consumers to switch between health insurance companies in search of better service.

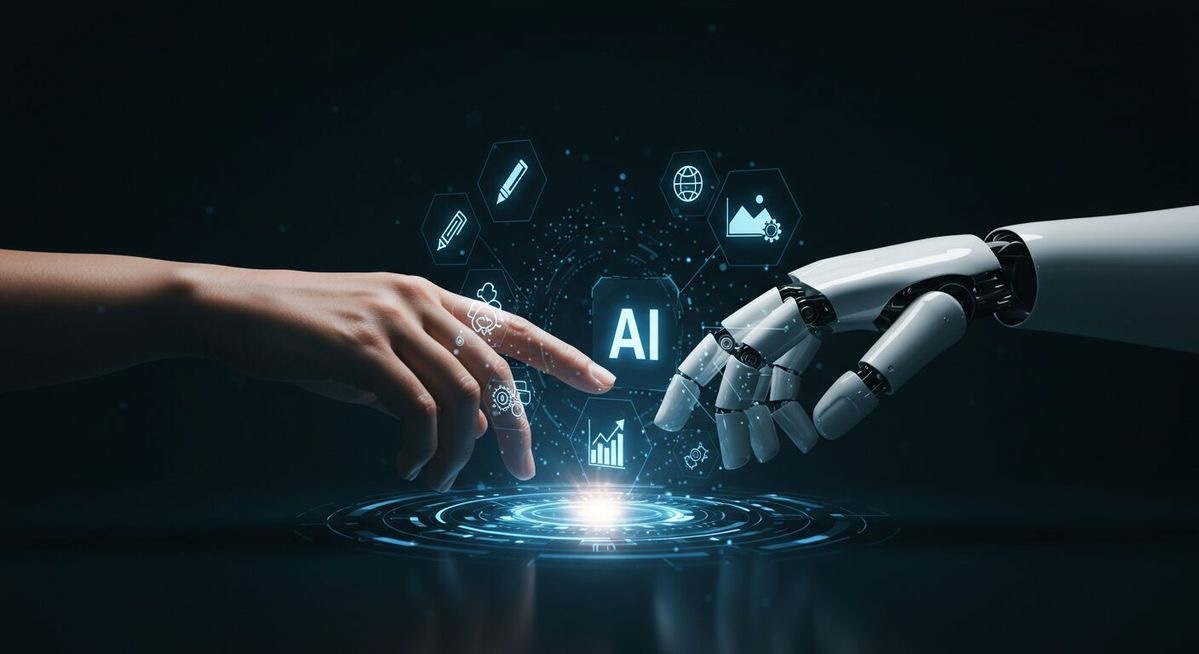

The GenAI Revolution: Your Health Insurance Digital Superhero

The best way to solve the above problems are using the GenAI to addresses these health insurance challenges by automating repetitive tasks, improving data analysis, and personalising customer interactions. Think of it as having a digital assistant that works 24/7, never makes human errors, and speaks every hospital’s language—specifically designed for health insurance optimisation.The image below illustrates how the claim management process can be improved

How GenAI Standardises Health Insurance Claims

1. Unified Digital Health Insurance Submission Framework

- Smart Form Conversion: GenAI converts handwritten/PDF bills into structured digital health insurance claims automatically

- Auto-Code Mapping: Detects non-standard treatment codes (like “ECG” vs “Electrocardiogram”) and maps to health insurance company-approved terminology

- Missing Data Alerts: Flags incomplete health insurance submissions before claim filing

2. Real-Time Health Insurance Practice Compliance Scoring

- Provider Rating System: GenAI analyses hospitals/clinics on documentation quality, billing transparency, and health insurance claim approval rates

- Preferred Network Incentives: Top-rated providers receive faster health insurance payments and higher patient referrals

3. Self-Learning Health Insurance Treatment Protocols

- Procedure Validation Engine: Cross-checks treatments against local medical guidelines and patient history for health insurance compliance

- Dynamic Pricing AI: Auto-adjusts health insurance claim amounts based on location and provider tier

4. Micro-Communication Automation for Health Insurance

- Instant Query Resolution: GenAI bots handle provider-side health insurance queries in regional languages

- Auto-Follow-Ups: Triggers reminders for pending documents and hospital attestations for health insurance processing

Valiance Solutions offers a cutting-edge solution for public as well as private players. By leveraging GenAI, Valiance Solutions has developed WSS , which actively enhances the process where large volumes of data sources often create significant delays. WSS automates data handling, document verification, fraud detection, and approvals, effectively streamlining the process. By eliminating manual interventions and improving data accuracy.