Client Background

Client is a digital insurance platform that helps corporate and individuals with their insurance needs. The platform allows customers to search, compare and buy various life and general insurance products online.

Business Context

To facilitate customers in buying process, client hires Point of Sale (POS) persons as agents. Following is a thorough process which agents recruitment undergo while coming onboard:

- Lead Generation: Lead initiates contact by filling up a form with basic demographic information

- KYC: Certain documentation is required by client to verify the Lead

- Training: Leads are trained to understand end customer’s requirement(s) and provide policies accordingly

- Certification: Client conducts exams to help leads become certified insurance agent recruitment

- Activation: Any lead that sells at least one insurance policy becomes active

- Repeat: Any lead that sells more than two insurance policies is a repeat

A variety of communications is sent by client to the leads throughout this process to track activity and measure engagement.

Business Problem and Objective

Client was facing a significantly high level of attrition across each stage in the onboarding process. While this was expected, out of total leads generated:

- Only 5.7% reach the activation stage

- Only 1.2% reach the repeat stage

The client wanted to increase the efficiency of this recruitment funnel leading to decreased training and onboarding costs as well as more policies sold. To achieve this objective, the client wanted to engage with a solutions provider that can provide the following:

- Help the client stitch together all the data collected throughout the onboarding process

- Analyse the stitched dataset to generate insights that can help in optimizing the process and filter unwanted leads

- Increase the conversion rate of leads towards active and repeat

Solution

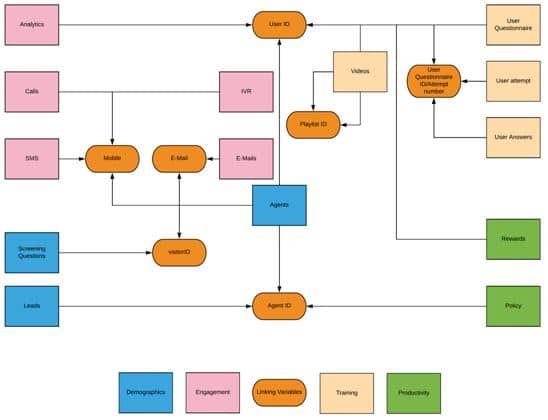

Valiance took a data driven approach to offer insights and indicators for optimizing the recruitment funnel and detecting high-potential recruits early. By performing a preliminary analysis we decided to use following datasets for further analysis:

- Demographic Data: age, gender, education, state

- App Usage: event name, timestamp of event, page, section

- Training Video Consumption: video start timestamp, playlist ID

- Call Data from Call Centre: call duration, call timestamp

- Timestamp of Stage Transitions: KYC done timestamp, KYC verified timestamp

We created a schema for all the data that we captured across all stages of the funnel. This helped us to look at the complete DNA of an individual agent recruitment.

Insights and Recommendations

Following indicators of progression through the funnel and productivity were discovered during the project:

- Leads aged 25 and above tend to be retained through the funnel better as compared to agents aged below 25.

- There seems to be a direct correlation between usage of the “Risk Meter” feature in the app before first sale and overall productivity.

- Leads who are called within 1 day of progressing from one stage to the other have a higher chance of progressing through the funnel.

Basis these insights, we provided following recommendation to client to optimise the funnel:

- Target leads aged 25 and above for lead generation.

- Monitor the use of “Risk Meter” feature by leads during the early stages and help them progress through the funnel quickly.

- Incentivise the use of this feature during the early stages of the funnel.

- Introduce training videos to help leads learn how to use this feature.

- Monitor stage transitions and prioritise calling leads who have progressed from one stage on the same day.